PLAY COMMUNICATIONS S.A. ANNOUNCES INTENTION TO FLOAT

ON THE WARSAW STOCK EXCHANGE

PLAY Communications S.A.1 (the “Company”), 100% owner of mobile operator P4 sp. z o.o. (branded as PLAY), one of Europe’s fastest growing telecom companies, today announces its intention to execute an initial public offering. PLAY Communications S.A. intends to apply for listing and admission of the Company’s ordinary shares on the main market of the Warsaw Stock Exchange.

Commenting on today’s announcement, Jørgen Bang-Jensen, Chief Executive Officer, said:

“PLAY is a unique company in the European telecoms sector. Our revenue growth and profitability outstrips our listed peers, as a result of our focused strategy and our status as Poland’s favourite brand. We have created a business model that enabled a challenger operator to take a market leading position within a few years, while generating free cash flow in line with the best in the industry. PLAY benefits from consistently strong performance of the Polish economy and the increasing sophistication of our customer base’s use of data, so we believe we can offer investors an unrivalled combination of growth and returns in our sector.”

PLAY Overview

PLAY operates the second largest and fastest growing mobile telecommunications network in Poland based on reported number of subscribers2, with over 14.3 million subscribers2 as of March 31, 2017. The Company has grown its market share of total reported subscribers in Poland, from approximately 4.6% at the end of 2008, to approximately 27.6% as of March 31, 2017. PLAY provides a wide range of mobile telecommunications services, including voice, data transmission services, messaging, video service (PLAY NOW) as well as Value Added Services and sales of handsets and other devices, to individual and business subscribers in Poland.

Key Strengths

Poland is one of the most attractive mobile communications markets in Europe with stable competitive dynamics

- The largest economy in the CEE region, demonstrating sustained growth and continued improvement in the macroeconomic environment, driving an increase in disposable income, purchasing power and falling unemployment

- The Polish economy has outperformed most others in Europe, with real GDP growth of 1.4%, 3.3%, 3.8% and 2.7% compared to an EU average of 0.3%, 1.7%, 2.2% and 1.8% in 2013, 2014, 2015 and 2016, respectively3

- Growing market, balanced competitive dynamic and favourable mobile communications environment have led to increased profitability, growing Adjusted EBITDA margins on a quarterly basis from 32.4% in the three months ended March 31, 2016, to 35.7% in three months ended March 31, 2017

PLAY is one of the fastest growing mobile communications operators in Poland and Europe

- Exceptional success story in Poland with a differentiating subscriber growth

- From December 31, 2007 to March 31, 2017, PLAY’s subscriber base grew at a CAGR of 37%4, to reach over 14.3 million subscribers as of March 31, 2017

- Consistent increase in market share year-on-year since launch

- One of the most successful recent entrants to the mobile communications market in Europe, reaching a subscriber market share of over 27% over ten years of operations

- As of March 31, 2017, PLAY’s brand image index exceeded that of the other mobile network operators (MNOs) in Poland5. The PLAY brand was recently assessed as the fourth most valuable Polish brand according to Polish newspaper Rzeczpospolita

- Highest net promoter score across a wider range of global telecommunications operators6

- The largest nationwide sales network of dedicated stores in Poland, with more than 850 PLAY branded stores, across over 420 cities, as of March 31, 2017

Lean cost structure designed to provide further profitability and margin expansion through increased scale

- Increased scale resulting in more efficient IT systems expenditure over the past three years, reducing IT operating and capital expenditures from 2.7% to 2.4% (as a percentage of operating revenue), from the years ended December 31, 2014 to 2016, respectively

- Ongoing optimization of network costs has sustainably supported traffic and increased data usage per subscriber from 853MB to 2,773MB, while simultaneously reducing network maintenance operating expenditures from 2.4% to 2.0% (as a percentage of operating revenue) for the years ended December 31, 2014 to 2016, respectively

Network strategy to support future subscriber growth

- Efficient network with competitive spectrum positioning to cover network requirements complemented by secure national roaming agreements

- IT infrastructure fully customizable and allows deployment of a significant number of new offers and processes with a short time to market

- Execution of a cost efficient full nationwide rollout of network (own total 4G LTE network covers 92.1% of the Polish population as of December 31, 2016; and 98.9% of the population living in urban areas as of December 31, 2016)

- First Polish MNO to launch LTE carrier aggregation 4G LTE Ultra technology; network enabling carrier aggregation covers 79.4% of the Polish population as of March 31, 2017

- Optimally managed the timing of 4G LTE roll out, avoiding both high 4G LTE infrastructure costs and narrow selection of 4G LTE devices available to the first mover in the Polish market

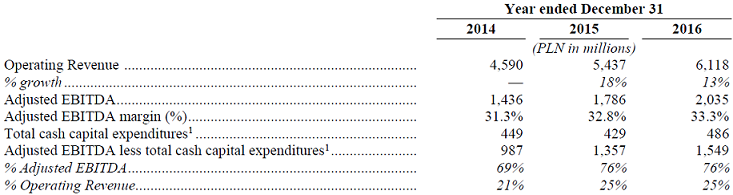

Impressive, consistent top-line growth and profitability supported by controlled, efficient capital expenditure leading to rapidly expanding cash flow conversion

- Growing subscriber base and attractive offerings, together with a strong focus on profitability, have historically yielded impressive results, expanding operating revenue and Adjusted EBITDA on a compound annualized basis by 15% and 19%, respectively, from 2014 to 2016

- Attractive Adjusted EBITDA margins of over 33% coupled with an efficient approach to capital expenditure have led to strong cash generation. As a result, Adjusted Cash Conversion, defined as Adjusted EBITDA less cash capex7 divided by Adjusted EBITDA, was 76% at year-end 2016

- Stable blended ARPU with constantly growing contract subscribers base, from 5.8 million (47.3% of total) as of December 31, 2014 to 8.7 million (60.5% of total) as of March 31, 2017

- PLAY’s management targets mid-single digit operating revenue growth over the medium term, in addition to a further improving Adjusted EBITDA margin, driven by operating leverage and completion of the nationwide network rollout that PLAY is undertaking

- PLAY targets annual run-rate capex expenditure (excluding leases and network expansion) as a percentage of operating revenue at approximately 8% per annum in the medium term. As part of the accelerated completion of its nationwide network roll-out, PLAY targets 2017 cash capex to be below PLN 700 million and PLAY also targets an additional PLN 500 million of spending spread over 2018 to 2020 on top of run-rate capex. PLAY is targeting a leverage policy of net reported debt to LTM Adjusted EBITDA of approximately 2.5x

Experienced management team with proven track record

- Experienced senior management team working together at PLAY for many years and with average telecoms sector experience of over 20 years

Post IPO Dividend Policy

- PLAY targets distributing a cash dividend for the FYE Dec-17 of PLN 650 million in Q2 2018 subject to approval by the Annual General Meeting, which the existing shareholders are committed to support

- For the following years (starting from the dividend for the year 2018 paid in 2019), PLAY targets to propose an annual cash dividend pay-out ratio of 65-75% of the preceding year Free Cash Flow to Equity post lease payments. Shareholder remuneration policy will be reviewed once the Company has reached its leverage objective of net reported debt to LTM Adjusted EBITDA of around 2.5x

- The dividend would be paid annually after approval by the Annual General Meeting

Offering Highlights

- The Offering will consist of a portion of the existing ordinary shares of PLAY Communications S.A. (the “Secondary Component”), a Luxembourg incorporated company, held by Play Holdings 1 S.à r.l., a company ultimately owned and controlled by Tollerton Investments Limited and Telco Holdings S.à r.l. The Offering consists of a public offering to retail investors, authorized employees and institutional investors in Poland and an international offering pursuant to Regulation S and Rule 144A

- PLAY intends to apply for listing and admission of all of the Company’s ordinary shares, including new shares issued to management in connection with the Offering as part of the settlement of the existing incentive scheme (the “Primary Management Issuance”), on the main market of the Warsaw Stock Exchange

- Play Holdings 1 S.à r.l. (the “Selling Shareholder”) will receive all of the proceeds from the Secondary Component and intends to use a part of these proceeds to redeem the Existing 2022 PIK Notes of its parent, Impera Holdings S.A. The Selling Shareholder will use the remaining portion of the Secondary Component to fund a distribution to its shareholders and to provide partial cash settlement of the existing incentive scheme

- Authorized employees will be eligible to subscribe for shares with a 15% discount and will be granted a guaranteed allocation (i.e., no proportional reduction) which is expected to be limited up to PLN 25,000 per employee, subject to a one year lock-up, which would require employees to hold or open investment accounts with PKO BP Securities

The Selling Shareholder believes that now, after a period of substantial growth, it is an appropriate time to monetise part of its ownership and to support the Company through the Offering which will provide PLAY with enhanced flexibility for its future financing and corporate strategy.

J.P. Morgan, BofA Merrill Lynch and UBS Investment Bank are acting as Joint Global Coordinators and Joint Bookrunners for the Offering. Bank Zachodni WBK S.A. and Dom Maklerski PKO Banku Polskiego are acting as Joint Bookrunners and Offering Agents.

The IPO is subject to the receipt of all relevant registrations and regulatory approvals.

Shareholder Structure

The Company is currently indirectly owned and controlled by Tollerton Investments Limited and Telco Holdings S.à r.l. who hold 50.3% and 49.7% of the share capital, respectively.

Enquiries

For Additional Information, Please Contact:

Citigate Dewe Rogerson (London)

David Westover

+44 207 282 2886

Sandra Novakov

+44 207 282 1089

Point of View (Warsaw)

Aleksandra Olek-Pawłowska

+48 601 960 004

Dariusz Sobczyński

+48 601 960 003

Play Communications S.A.

Anna Kaim – Investor Relations

+352 28 68 48 130

PLAY

Marcin Gruszka – Media Relations

Marek Chrusciel – Treasury, Investor Relations

+48 790 30 00 20

+48 790 00 55 00

Financial Highlights

During the three-month period ended March 31, 2017, PLAY generated total operating revenues of PLN 1,581 million, which represented an increase of 9.6% period on period versus 2016. Adjusted EBITDA for the three month period ended March 31, 2017 amounted to PLN 564 million, an increase of 20.8% period on period in PLN terms.

PLAY’s financial policy targets mid-single digit operating revenue growth over the medium term. PLAY is also targeting an improved Adjusted EBITDA margin, driven by operating leverage and completion of the nationwide network rollout that PLAY is undertaking. PLAY targets annual run-rate capex expenditure (excluding leases and network expansion) as a percentage of operating revenue at approximately 8% per annum in the medium term. In terms of expenditure on network expansion, PLAY targets cash capex to be below PLN 700 million for full year 2017, reflecting PLAY’s ongoing investments into the accelerated completion of the nationwide network rollout, and targets an additional PLN 500 million of spending spread over 2018 to 2020 on top of PLAY’s run-rate capex. PLAY is targeting a leverage policy of net reported debt to LTM Adjusted EBITDA of approximately 2.5x.

The foregoing statements may constitute forward-looking statements and investors are cautioned not to rely thereon; for further information see “IMPORTANT NOTICE” section below.

About PLAY

PLAY is the second largest MNO in Poland based on reported number of subscribers, with over 14.3 million subscribers, as of March 31, 2017. It is also the number one brand in Poland based on SMARTSCOPE market research. It is also the market leader in subscriber net additions in Poland, with more than 48% of all contract subscriber net additions in the quarter ended March 31, 2017. PLAY’s growth is underscored by the SMARTSCOPE research that ranked it with the highest “Brand Image Index” and “top of the mind advertising awareness” score of the four major MNOs in Poland. Further, PLAY has maintained growth in its contract subscriber base, which has steadily increased as a percentage of total reported subscriber base, from 47.3% as of December 31, 2014 to 60.5% as of March 31, 2017. Retail contract revenue represented 77.1%, 77.3% and 78.1% of total usage revenues for the years ended December 31, 2014, 2015 and 2016 respectively and 80.5% of total usage revenues for the three months ended March 31, 2017. PLAY believes it will continue to increase its blended ARPU and maintain or continue to lower its already low churn rates, which are consistently below the average levels observed for its competitors in the market. In addition, contract subscribers provide the benefit of revenue stability and security due to fixed contract durations.

About the Polish Wireless Sector

The Polish mobile communications market is well balanced in terms of the relative market shares of the largest four MNOs, and the relatively similar manner in which they operate, particularly when compared to the fixed line market, which is more fragmented. In 2016, the Polish mobile communications market was the main revenue contributor to the Polish communications market, generating revenues of approximately PLN 26.3 billion based on the publicly reported revenues of the four major Polish MNOs (approximately five times the fixed line and fixed broadband market revenue). In terms of total number of users, Poland had approximately 52.0 million reported SIM cards, implying a penetration rate of 135.3% as of March 31, 2017. Cumulative mobile communications revenues of the largest four MNOs have grown at a CAGR of 4.2% from 2014 to 2016, along with number of contract subscribers, which have grown from 28.3 million to 32.9 million over the same period. The Company believes there is still opportunity for further mobile communications service revenue growth in Poland, particularly driven by the increase in smartphone penetration which is expected to support an increase in data usage, mobile broadband services and growth in business customers.

Current pricing and market structure support mobile communications platform bundling, while fixed-mobile bundling uptake has been historically limited in Poland. Bundling in Poland is mainly relegated to double-play offers (these currently represent a 77% share of the total bundle uptake per UKE); primarily mobile telephony and mobile broadband. Historically, fixed-mobile bundling has not been very successful in the Polish market due to low speed infrastructure (due to topography that is more favourable to mobile over fixed-line technology) and a fragmented landscape of fixed broadband and cable television players, among other reasons. While, according to Analysys Mason, mobile communications operators cover more than 99% of the population, the fixed broadband market in Poland is fragmented, covering only 53% of Polish households with quality broadband access. For these reasons the importance of the mobile communications platform in Poland is paramount and, according to PMR, has led to mobile broadband representing 52% percent of all internet subscribers. As per the EU Digital Agenda Scoreboard 2016, Poland also had the sixth highest mobile broadband penetration in Europe, amounting to 114.6%, above the EU 28 average of 84.7% (as of June 30, 2016 and defined as subscriptions per 100 people).

IMPORTANT NOTICE

The information contained in this announcement is for background purposes only and does not purport to be full or complete. No reliance may be placed by any person for any purpose on the information contained in this announcement or its accuracy, fairness or completeness.

This document is an advertisement of the Company and not a prospectus for the purposes of applicable measures implementing EU Directive 2003/71/EC (as amended) (such Directive, together with any applicable implementing measures in the relevant home Member State under such Directive and other applicable regulations, the “Prospectus Directive”) and as such does not constitute an offer to sell, or the solicitation of an offer to purchase, securities. A prospectus prepared pursuant to the Prospectus Directive in English together with its Polish summary will be published, which when approved by the Luxembourg Commission de Surveillance du Secteur Financier – the Luxembourg capital markets authority, will be the sole legally binding document containing information on the Company and the offering of the Company’s securities in Poland as well as on their admission and introduction to trading on a regulated market organized by the Warsaw Stock Exchange and which, when published upon being notified by the Luxembourg Commission de Surveillance du Secteur Financier to the Polish Financial Supervision Authority (Komisja Nadzoru Finansowego), will be obtained from the website of the Company and the website of the Luxembourg Stock Exchange (www.bourse.lu).

These materials are not for distribution, directly or indirectly, in or into the U.S., or in other countries where the public dissemination of the information contained herein may be restricted or prohibited by law. They do not constitute an offer of securities for sale or an invitation to subscribe for or purchase securities. It may be unlawful to distribute this document in certain jurisdictions. This document is not for distribution in Canada, Japan or Australia. The information in this document does not constitute an offer of securities for sale in Canada, Japan or Australia.

This communication is only addressed to, and the securities referred to herein shall be offered only to, qualified investors within the meaning of Article 2(1)(e) of Prospectus Directive and/or in other circumstances falling within Article 3(2) of the Prospectus Directive. Any such qualified investor will also be deemed to have represented and agreed that any such securities acquired by it in the offer have not been acquired on behalf of persons other than such Qualified Investors.

In the United Kingdom this announcement is being distributed only to and is directed only at (a) persons outside the United Kingdom, (b) persons who have professional experience in matters relating to investments falling within the definition of “investment professionals” in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the „Order”), or (c) high net worth entities falling within Article 49(2)(a) to (d) of the Order, and (d) other persons to whom it may be lawfully communicated (all such persons together being referred to as „relevant persons”). The securities are available only to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be available only to or will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this communication or any of its contents.

In connection with the Offering of the securities, J.P. Morgan Securities plc, Bank Zachodni WBK S.A., Merrill Lynch International, PKO BP DM and UBS Limited and any of their affiliates, may take up a portion of the securities in the Offering as a principal position and in that capacity may retain, purchase, sell, offer to sell for their own accounts such securities and other securities of the Company or related investments in connection with the Offering or otherwise. Accordingly, references in the Prospectus, once published, to the Sale Shares being issued, offered, subscribed, acquired, placed or otherwise dealt in should be read as including any issue or offer to, or subscription, acquisition, placing or dealing by, J.P. Morgan Securities plc, Bank Zachodni WBK S.A., Merrill Lynch International, PKO BP DM and UBS Limited and any of their affiliates acting in such capacity. In addition J.P. Morgan Securities plc, Bank Zachodni WBK S.A., Merrill Lynch International, PKO BP DM and UBS Limited and any of their affiliates may enter into financing arrangements (including swaps or contracts for differences) with investors in connection with which J.P. Morgan Securities plc, Bank Zachodni WBK S.A., Merrill Lynch International, PKO BP DM and UBS Limited and any of their affiliates may from time to time acquire, hold or dispose of securities. J.P. Morgan Securities plc, Bank Zachodni WBK S.A., Merrill Lynch International, PKO BP DM and UBS Limited do not intend to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory obligations to do so.

In connection with the Offering, a stabilisation manager, or any of its agents, may (but will be under no obligation to), to the extent permitted by applicable law, over-allot Sale Shares or effect other transactions with a view to supporting the market price of the Sale Shares at a higher level than that which might otherwise prevail in the open market. Such transactions may be effected on any stock market, over-the-counter market, stock exchange or otherwise and may be undertaken at any time during the period commencing on the first day of listing of the Sale Shares on the Warsaw Stock Exchange and ending no later than 30 calendar days thereafter. However, there will be no obligation on the stabilisation manager or any of its agents to effect stabilising transactions and there is no assurance that stabilising transactions will be undertaken. Such stabilising measures, if commenced, may be discontinued at any time without prior notice. In no event will measures be taken to stabilise the market price of the Sale Shares above the offer price. Save as required by law or regulation, neither the stabilisation manager nor any of its agents intends to disclose the extent of any over-allotments made and/or stabilisation transactions conducted in relation to the Offering. Any Over-allotment Shares made available pursuant to the over-allotment arrangements, including for all dividends and other distributions declared, made or paid on the Sale Shares, will be purchased on the same terms and conditions as the Sale Shares being issued or sold in the Offering and will form a single class for all purposes with the other Sale Shares.

Statements contained herein may constitute “forward-looking statements”. Forward-looking statements are generally identifiable by the use of the words “is likely to”, “aim”, „may”, “might”, „will”, “could”, “would”, „should”, „plan”, „expect”, „anticipate”, „estimate”, „believe”, „intend”, “seek”, „project”, “predict”, “potential”, “continue”, “contemplate”, “possible”, „goal” or „target” or the negative of these words or other variations on these words or comparable terminology.

Forward-looking statements involve a number of known and unknown risks, uncertainties and other factors that could cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. The Company does not undertake publicly to update or revise any forward-looking statement that may be made herein, whether as a result of new information, future events or otherwise.

1Play Holdings 2 S.à. r.l. will be converted into Play Communications S.A. before launch of the IPO.

2Number of SIM cards.

3Per EIU.

4CAGR for total subscribers (incl. MVNOs).

5Per Smartscope survey.

6Per Analysys Mason.

7Total cash capital expenditure excluding cash outflows in relation to frequency reservation acquisition.